Career Comedown: When Ambition Stops Feeling Good

Feeling stuck in your career despite doing everything right? In this episode of The Wallet podcast, Emilie Bellet speaks with Stephanie Sword-Williams about career comedown, money security, and redefining success on your own terms.

How to Build a Money System That Actually Works

Feeling organised with money but still unsure or overwhelmed? This guide shares a simple 90-day framework to build a money system that brings clarity, control, and confidence, without jargon or overwhelm.

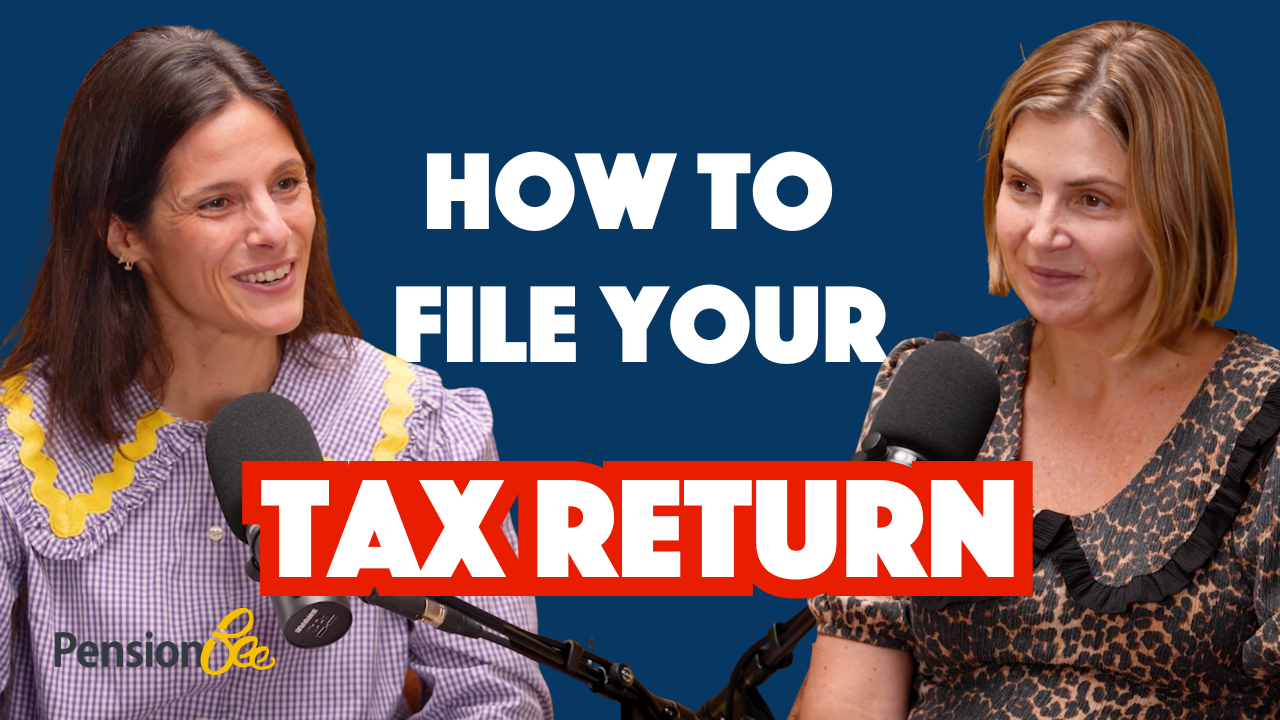

Your Self-Assessment Tax Return Guide

The Self Assessment deadline has a habit of arriving faster than expected.

This episode covers who needs to file, what needs reporting, and how to avoid common pitfalls - with practical guidance for anyone who is self-employed, earning extra income, or managing a more complex tax setup.

Vestpod founder Emilie Bellet speaks with Maike Currie, VP of Personal Finance at PensionBee, about key deadlines, pension considerations, and how Making Tax Digital will change the process from 2026.

This episode is for general information only and does not constitute personal tax or financial advice.

The Psychology Behind Holiday Spending

December has a way of making money feel heavier than usual. Between the pressure to buy, give, host, and keep everything running, spending can quietly shift from intentional to emotional.

On this episode of The Wallet podcast, Emilie Bellet speaks with psychotherapist Holli Rubin about the psychology behind holiday spending. Together, they explore what is actually happening in the brain during December, why spending can offer short-term relief, and how stress, shame, family expectations, and old money stories shape our behaviour far more than logic alone.

This conversation is not about doing Christmas “properly” or cutting back for the sake of it. It is about understanding your responses, recognising when spending becomes a nervous system reaction, and approaching the festive season with more awareness, clearer boundaries, and less pressure.

UK Budget 2025, What Rachel Reeves’ Changes Mean for Your Money

A clear breakdown of Rachel Reeves’ latest UK Budget and how it will shape your finances. From pension rises and benefit changes to tax freezes, ISA limits and new charges for drivers and landlords, this guide explains what’s coming, who is affected and how these shifts may show up in your monthly budget.

The Gender Pension Gap Hits £113,000: What Women Need to Know

Women are retiring with £113,000 less than men. Scottish Widows’ new report reveals why — and the practical steps you can take to protect your future.

Ask the Bot? How Technology Is Changing the Way We Learn

AI is reshaping how people learn about money. From budgeting apps to chatbots, it’s helping millennials and Gen Z feel more confident with their finances — but human judgement still matters.

How Pensions Work (And Why They Matter More Than You Think)

A clear, friendly guide to how pensions really work — contributions, tax relief, investments and why starting early can transform your long-term financial security.

Financial Education Is Coming to Schools: What It Means for the Next Generation

Financial education will soon be taught in UK schools under the new Children’s Wellbeing and Schools Bill. Here’s what pupils will learn — and why campaigners like Martin Lewis, GoHenry and Money Ready say it matters.

How To Invest Your First £100 (And Start Growing Your Money)

Let’s be honest — “start investing” has probably been sitting on your to-do list for months (or years). You know it’s important, but it can feel confusing, risky, or just… something future-you will figure out.

The truth? You don’t need thousands of pounds or a finance degree to begin. You can start investing with as little as £100 — and doing it today can make a real difference to your financial future.

This is your simple, no-jargon guide to getting started.

Experian’s Credit Score Shake-Up: Rent Payments Now Count – Here’s What It Means for You

Experian’s new UK credit score includes rent payments and everyday habits. Learn how credit scores work, why they matter, and how to improve yours.

10 Clear Thinking Lessons That Changed How I Make Decisions

Discover 10 powerful lessons from Shane Parrish’s Clear Thinking that can help you make better decisions in work, life, and everyday moments.

Overcoming Money Anxiety: What It Is, Why It Happens, and 5 Ways to Feel More in Control

Feel stressed or guilty about money? Learn what money anxiety is, why it happens, and how to take simple steps to regain control and confidence with your finances.

Money Playbook for Freelancers

Freelancers, welcome to Episode 10 — the final episode of our Finances for Freelancers series. We’ve broken down the essentials every freelancer or solopreneur needs to feel confident with money — from budgeting and taxes to pensions and pricing.

Today, we’re wrapping up with a punchy roundup — each of our expert guests shares one final, powerful tip to help you stay on track with your finances.

How to Think Like a Business Owner

Freelancers, are you thinking beyond client work? In this episode of Finances for Freelancers, Victoria Nabarro FPFS, Chartered Financial Planner and founder of Veda Wealth, shares how to invest, scale your business, and build financial freedom.

We cover smart ways to reinvest, outsource, create passive income, and set financial goals for growth. If you want to move beyond the freelance hustle, this episode is for you.

How to Create Consistent Income with Lara Sheldrake

In this episode, we’re tackling one of the biggest challenges freelancers face: managing cash flow when income is unpredictable. How do you stay afloat during a slow month? What’s the best way to deal with late payments? And how can you create a more stable income without burning out?

Joining Emilie Bellet is Lara Sheldrake—entrepreneur, community builder, and founder of Found & Flourish. Lara shares her personal strategies for staying financially steady in a freelance world: from tracking income and ghost spending, to diversifying revenue and planning for quieter months.

We talk about setting realistic income goals, structuring your week with a CEO day, and working with your energy—not against it.

How to Budget with a Fluctuating Income

In this episode, we’re tackling a topic that freelancers often put on the back burner: pensions. How do you start saving for retirement when you don’t have a traditional workplace pension? How can you make the most of tax relief? And what are the best strategies for long-term financial security?

Joining Emilie Bellet is Lisa Picardo, Chief Business Officer UK at PensionBee. Lisa is here to break down why pensions matter for freelancers, how to set one up, and what you can do today to secure your financial future.

The Clock’s Ticking: Use Your ISA Allowance Before 5 April

The end of the tax year is fast approaching, and if you don’t take action before 5 April, you could miss out on valuable tax-free savings and allowances. Unlike some financial deadlines that roll over, many allowances reset completely—meaning if you don’t use them, you lose them.

From maximising your ISA allowance to boosting your pension and checking for overpaid tax, here’s what you need to do before the 2024/25 tax year deadline.

Freelancer Pensions 101

In this episode, we’re tackling a topic that freelancers often put on the back burner: pensions. How do you start saving for retirement when you don’t have a traditional workplace pension? How can you make the most of tax relief? And what are the best strategies for long-term financial security?

Joining Emilie Bellet is Lisa Picardo, Chief Business Officer UK at PensionBee. Lisa is here to break down why pensions matter for freelancers, how to set one up, and what you can do today to secure your financial future.

Market Volatility: Why Staying the Course Matters

If you’ve been watching the markets recently, you might be feeling uneasy. Market fluctuations can be unsettling, and it’s natural to wonder whether you should make changes to your investments. But before making any decisions, let’s take a step back.

Short-term dips can be alarming, but when we zoom out, the bigger picture often tells a different story. While the S&P 500 has seen a decline in recent months, the long-term trend over the past five years still shows steady growth. History suggests that markets recover, and those who stay invested tend to benefit over time.